How much money are you actually making at your restaurant? That’s exactly what a restaurant profit and loss statement can tell you.

Let’s break it down by one of the most common menu items in the United States: Pizza. Popular restaurant chain Domino’s charges $17.99 for a large (14”) pepperoni pizza in the Boston area. But Domino’s doesn’t make $17.99 on the pizza. Every pie costs money in ingredients (flour, cheese, sauce, spices, pepperoni), labor (the average MA Domino’s employee makes $16/hour), and packaging (pizza box).

What’s left over after all of those costs is the profit on that particular pizza. And that doesn’t even include fixed costs like rent on the kitchen space, utility and heating, appliances, and other overhead.

Answering the question of how much money you’re making as a restaurant owner can get complicated fast. But whether you’re using a team of accountants or managing the books yourself, you’ll need to put together a profit and loss statement (often shortened to the phrase “P&L”) to tell you just that. Here’s everything you need to know about creating and reading one:

What Is a Restaurant Profit and Loss Statement?

A profit and loss statement provides a record of a restaurant’s financial health by outlining revenue, costs, and expenses during a set period of time — usually over a fiscal year, but it can be more frequent depending on your management style or if you’re part of a public company. Another word for a profit and loss statement is an income statement, because it shows your overall restaurant income for the year.

Your profit and loss statement goes into detail for each revenue and expense to determine your net income, or profit. Here’s the basic equation:

- Profit = (Total Revenue + Gains) – (Total Expenses + Losses)

A good way to remember this is thinking back to the Domino’s example. At the end of a given pizza, how much of that $17.99 does the restaurant actually see? Profit is ultimately what your restaurant “pockets” at the end of the year after paying for restaurant space, food and beverage supplies, employee wages and tips, and other overhead, like linens, decor, or appliances.

Keeping up a regular P&L statement helps you assess your restaurant’s financial health so you know exactly what’s coming in and what’s coming out — so you can make sure your restaurant stays as profitable as possible.

How Often Should You Update Your Restaurant P&L Statement?

A P&L is one of the building blocks of your restaurant accounting and should be updated on a regular basis, though the exact timing is up to you. Because it’s a helpful snapshot of your restaurant’s financial health, many restaurant owners prepare one weekly or monthly. If you have multiple restaurants, you’ll want to create a profit and loss statement for each individual unit as well as your business as a whole.

Monitoring your P&L gives you insight into:

- Whether or not your restaurant is profitable — which can take time

- How to prioritize business decisions, like adding new menu items, changing suppliers, or hiring and staffing

- Where your “money makers” are on your menu

- Any inconsistencies or losses that don’t make sense, which is a sign of theft

- At a minimum, it should be prepared each quarter as part of your quarterly taxes.

Many point-of-sale systems automatically generate P&Ls on an ongoing basis so you can see an updated dashboard of your performance.

What is Included in a Profit and Loss Statement?

Restaurant owners create P&L statements in one of two accounting methods: Cash and accrual.

- The cash method is the simplest accounting method and focuses on money flowing in and money flowing out. Restaurants record transactions for every cover and record liabilities (expenses and losses) whenever bills come due.

- The accrual method records revenue as it is earned, rather than when cash is received. This method is more common for businesses that provide services or products, such as retail or software, where customers order in advance before receiving payment.

These two methods differ on the specifics included in your profit and loss statement, and how far in the future you record sales and expenses. Which method you choose is up to you (and may be worth chatting with an accountant about.)

In both methods, however, profit and loss statements include each element that makes up profit:

- Sales and revenues by category: Food, wine, liquor, merchandise, for example

- Costs of goods sold (COGS) by category: Typically, how much it costs for your ingredients.

- Labor: Wages, tips, and salaried employees

Incidental operating expenses: The types of costs that fluctuate, like advertising, miscellaneous repairs, administrative expenses like credit card fees, utilities, live music, and so on - Fixed costs: Monthly rent, insurance, and other overhead costs you cannot change or control

- Depreciation: Over time, your assets, like appliances and restaurant equipment, depreciate in value. Calculate this cost using this formula.

Subtracting the sum of all of your costs (labor, operating expenses, fixed costs) from your sales and revenues will give you net profit.

Note that profit typically is calculated before taxes. Many P&Ls include an “income before taxes” line and then a line to calculate your taxes afterwards.

How to Create a Restaurant P&L Statement

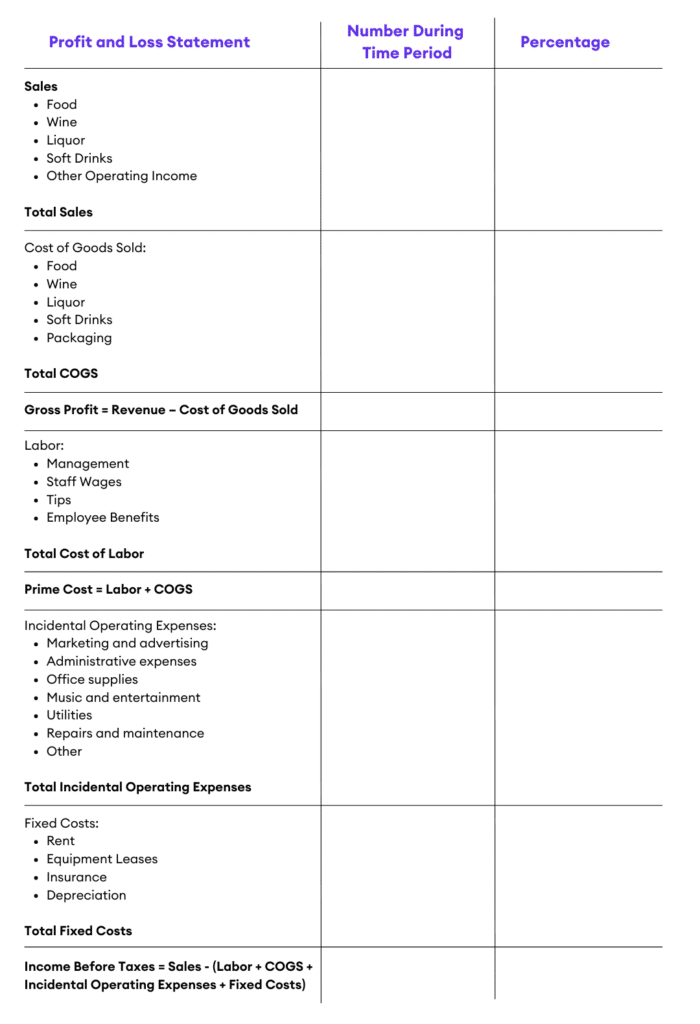

Now, it’s time to put all of those elements together. Here’s an example of what a P&L statement could look like for a restaurant. You’ll want to make sure you include the categories and costs most relevant to you, but you can start with this template.

This example below takes a high-level approach, but it’s worth creating a detailed examination of at least your expenses, if not your revenue by menu item, at least once every quarter.

How to Analyze a Restaurant Profit and Loss Statement

Ok, here’s some bad news: The average profit margin for a restaurant is less than 5%. The restaurant industry has famously paper-thin profit margins, which is exactly why 60% of restaurants fail in the first year.

That’s exactly why creating a profit and loss statement is so helpful. Besides getting your books in order so you can accurately pay your taxes and manage your business, it’s the best way to understand the overall financial health of your restaurant.

Few restaurant owners sign up for this part of the deal. You’re likely passionate about food and creating deep, meaningful experiences for your customers — not crunching numbers. But taking a hard look at your profit and loss statement can help you balance your overall costs and make better business decisions, whether that’s looking at specific ingredients in season, choosing new table linens, or deciding whether or not to hire that extra server.

In addition to pulling together all of your revenue and expenses, your profit and loss statement will include several restaurant calculations to help you better understand your business:

Percentage of sales

The first area of your P&L to examine is your revenue by category (or if you’re getting detailed, your revenue by menu item.) To be able to make better decisions on your offerings and on your marketing and sales, you need to know exactly which categories perform well and which don’t.

For example, your wine list may be a powerhouse, making up the majority of your sales. If that’s the case, then highlighting your wine list in marketing materials, training your staff on your different wine offerings, or streamlining other drink choices that aren’t performing as well can help you optimize your revenue.

Gross profit = Revenue – COGS

Gross profit is the first measure of your business health. This is different from your final profit number at the end of your P&L. What this tells you is specifically how profitable your menu is — how much are you bringing in and how much is coming out based on your specific menu items and the cost of the ingredients to make them.

Knowing this allows you to start to dissect your menu to understand which items are worth keeping and which aren’t helping your restaurant grow. It’s also a good place to look at your suppliers and whether or not they’re contributing positively for your business. This might mean purchasing items in bulk or working with local suppliers that charge less for shipping or delivery.

Prime cost: COGS + Labor

Prime cost usually makes up 60% of your total costs. Calculating prime cost gives you a window into your two biggest expenses that you can (theoretically) control. You won’t necessarily be able to negotiate or change your rent, but you can change suppliers, menu items, and adjust staffing accordingly.

Restaurants typically have two levers to increase their profit: Increasing menu prices or decreasing their prime cost.

Net Profit = (Total Revenue + Gains) – (Total Expenses + Losses)

This is the big one! Your net profit is the overall profit that you’ve earned over the given time period. Ideally, this number is positive — often called being “in the black” — but for many restaurants, it takes years to reach profitability.

To increase your profit margin, you’ll need to look at both sides of the equation, increasing your total revenue and decreasing your total expenses.

What Comes Next? Improve Your Margins!

Of course, figuring out what your restaurant is important — but it’s what you do with that information that really matters. From rethinking your menu strategy to implementing new technology, there are countless ways to uncover new efficiencies and reduce costs, using your P&L as your guide.

(If you want to learn more about how digitizing tip payouts can save your team time, make them happy — and yes, improve those margins — get a demo here!)