tip Reporting Software for Restaurants

Kickfin’s robust reporting features give you 100% visibility into every tip payout by employee, shift, site and more.

“An extremely easy-to-use tool that keeps our team members happy. The reporting tools help balance accounting and payroll to make sure that tips are claimed and taxed appropriately and that the business is in compliance with laws."

Justin C., Area General Manager

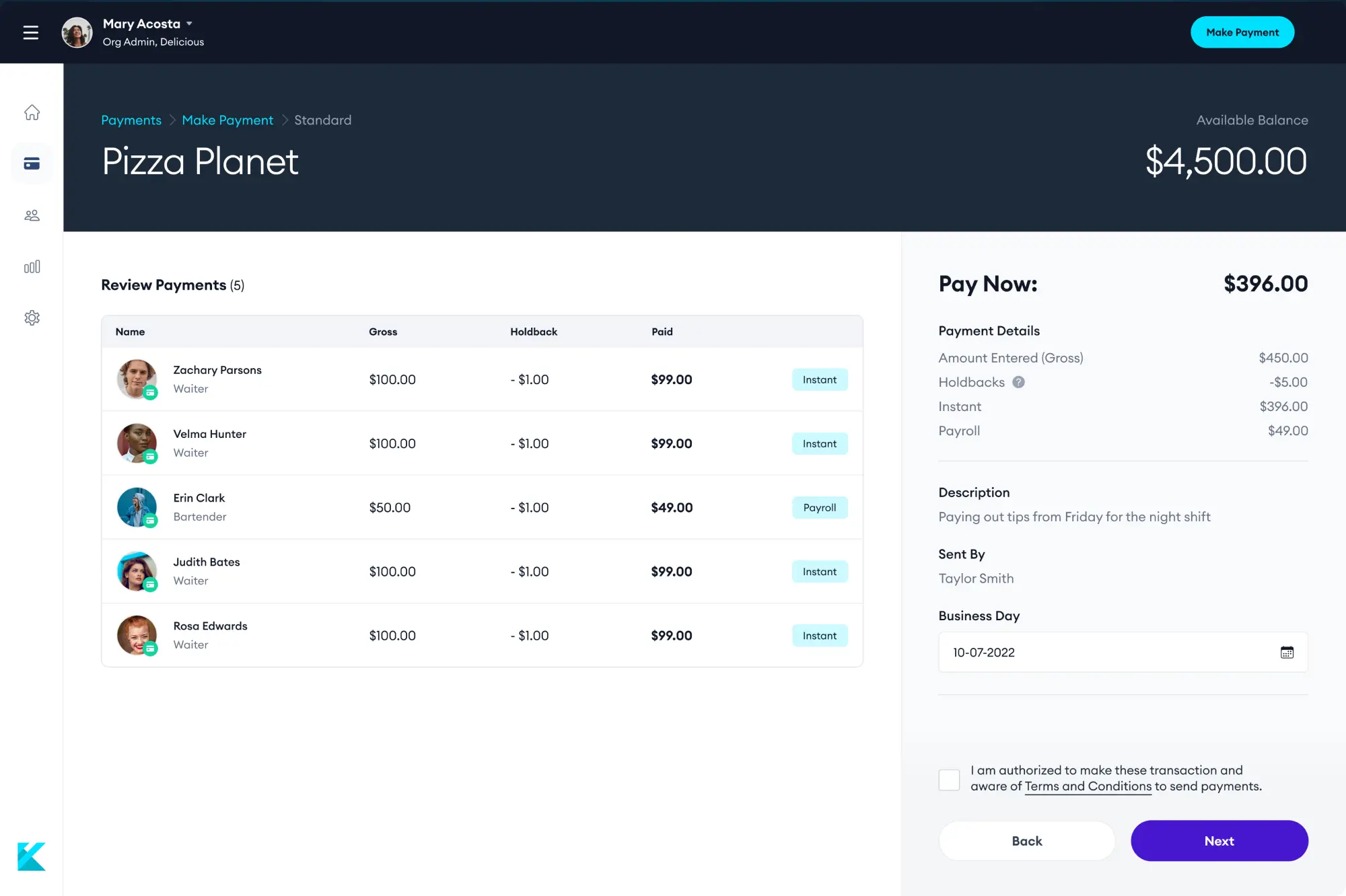

Never referee a tip dispute again. With Kickfin’s easy-to-use tip reporting capabilities, you can see who got paid, when they were paid, and how that amount was calculated.

Leave no room for error: With Kickfin, all payments are trackable and auditable, and reports can be synced with other systems.

Tipping regulations are tricky. Kickfin's tip tracking software helps ensure compliance with laws in your jursidiction.

Never mediate a tip dispute again. Kickfin gives employees full visibility into their payment history, including calculations.

Kickfin’s tip reporting features allow you to choose from different types of reports, depending on what you want to track. For every payment, you can see time and date stamps — as well as how the tip was calculated if you’re leveraging Kickfin’s tip pooling software. You can also pull reports for bank reconciliation, payroll reporting, and more.

Pull reports for the entire organization, or filter based on individual employee, shift, site and more.

Easily sync Kickfin’s tip payout data with your payroll system or software to ensure accuracy and make payroll processing a breeze.

“It drastically helped us with tracking our tips and what we pay out to our employees.”

Leo C., Operating Partner

“Easy to implement, great tracking and security features”

Bradford B., Operations Director

“My favorite part about Kickfin is the reporting functions - especially the ‘Business Date’ feature.”

Erik S., Accountant

“Great system. So easy to use.”

Thomas W., Admin

“Kickfin makes it so easy to find and audit the tip reports”

Brad P., Manager

“A game changer”

Chris D., Owner

success story

Full service | Nightlife

“Our managers were regularly withdrawing $40,000 of cash to pay out tips. It wasn't safe."

“We’ve done cash tips. We’ve done tips on payroll. We’ve tried prepaid cards. None of those keep you competitive with other employers. Kickfin does.”

Kickfin’s tip reporting software helps restaurants accurately manage and track your employees’ tip payouts — in real-time. Leveraging our tip reporting capabilities can effectively streamline payroll and accounting processes, while ensuring you’re compliant with tip and labor regulations. It also provides transparency for you and your team, so you can see who was paid, when they were paid, how much they were paid, and how that tip amount was calculated.

Kickfin offers multiple reports that detail payments paid, bank reconciliation, payroll reporting and more. All of our reports can be downloaded into a CSV file that can be used to import into other systems/programs.

Yes, we can work with your team to create custom reporting if needed.

Kickfin’s reporting allows full visibility to see what manager issued which specific payment (or batch of payments) to which individual(s), with time and date stamps for maximum visibility and transparency. All payments are fully trackable and auditable.

Employees can log into their own accounts and see a history of all payments made to them. This history is also exportable to .CSV files. If you’re using the integrated calculator, employees can also see the details of the calculation used to determine their tip amount.

No, Kickfin does not automatically report anything for tax purposes. But the reports available allow you and your employees the access to the information needed to be tax compliant.