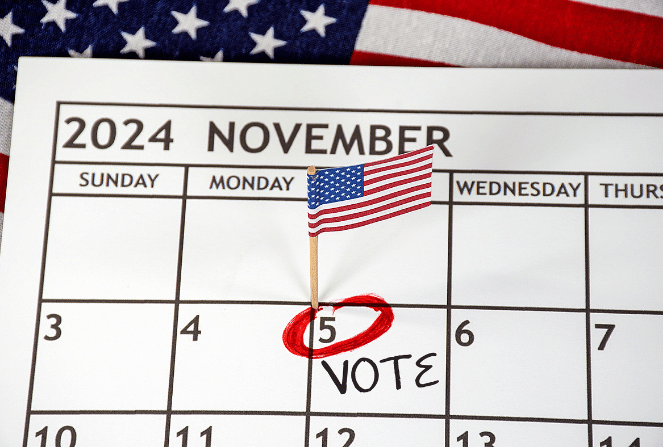

It’s an election year, in case you haven’t heard! 😉 This one has major implications for tipped employees — specifically, when it comes to taxes.

It’s no secret that our Democratic and Republican candidates are running on very different platforms. But when it comes to tip regulations, Vice President Kamala Harris and Former President Donald Trump actually both support reducing taxes on tips.

A little context on taxes and tips

We’re just going to state the obvious: For the average American, tax reporting can be pretty, pretty confusing. For the millions of employees working in tipped occupations — well, that creates another layer of uncertainties.

(Do I have to report my tips? Do have to report my cash tips? Will anyone know if I don’t report my tips? What happens if I don’t accurately or fully report what I earned?)

Historically, there’s been a trend of hospitality employees underreporting cash tips to prevent higher tax burdens. And while this may reduce what employees owe Uncle Sam in the moment, there can be downsides: e.g., if they find themselves eligible for unemployment, if they’re trying to qualify for an auto loan or mortgage, etc.

However, that urge to underreport could be relieved in the near future, given the tax code changes both of our presidential candidates have proposed. The TL;DR: Both Trump and Harris have voiced their intention to relieve some of the burden on tipped workers in restaurants, bars, hotels, and other service positions.

Here’s a quick summary of each candidate’s plan, as well as some potential impacts for restaurant employees.

Trump’s plan for tipped employees

Trump shared his plan to reduce tipped income tax burden at a rally in Las Vegas — fitting for a city that’s built on the gig economy. Nevada is home to the highest concentration of tipped employees who work in the many hotels, casinos, and restaurants that millions of tourists flock to annually.

During the rally, the former president announced that he would make tipped income exempt from federal income tax, stating it would happen “right away” when he takes office.

Since speaking at the rally, Trump has not yet clarified what this would mean for tipped employees. Many servers want to know if this is an exemption just on federal income tax or if the proposal includes payroll taxes (social security and Medicare).

Harris’s tip tax proposal

Harris also took the opportunity to speak on her tipped income policy while visiting Nevada. Much like Trump, she knew she’d have a captive audience when it comes to tipped earnings.

Her proposal promises to exempt tipped income from the federal income tax, but she has made clear that tips will still be subject to payroll taxes. While not yet confirmed, campaign insiders say Harris is considering placing some guardrails on her plan — like a caveat that the tax exemption only applies to employees earning less than $75,000 per year.

Is one plan better than the other?

In short: probably not. (Most service and hospitality workers do not earn above the $75,000 threshold that’s been suggested by the Harris campaign.) So either way, servers, bartenders, and hospitality staff can expect to see a lower tax burden during the next administration.

But what does that look like in practice?

Most tipped employees aren’t receiving their tips on payroll — they’re walking out of every shift with their earnings for the night, deduction-free. Instead, the taxes are paid on payroll out of their hourly earnings, which is why many servers get $0 paychecks every two weeks. With a reduced tax burden, most servers will see the difference in higher paychecks.

On the other hand, economists are wary of the impact of eliminating taxes on tips, citing the reduced funding for social security and Medicare. And with so much negative sentiment around “tipflation” these days, experts also speculate that a reduced tax burden may result in even more hesitance at the tip screen.

Increasing minimum wage

We’re closely following campaign promises about an increase to the minimum wage — especially in regards to the tipped minimum wage and the tip credit.

Minimum wage earners have been eyeing an increase, noting that the federal minimum wage of $7.25 per hour hasn’t increased since 2009, and servers, bartenders, and other tipped employees have been earning $2.13 per hour for over 30 years. An increased minimum wage paired with the reduced tax burden could make a major difference for service workers trying to keep up with the rising cost of living.

In the Harris camp, removing tax on tips is just part of the plan to take some pressure off service workers. While Harris hasn’t shared a detailed plan for bumping up the minimum wage, she has indicated that she would support an increase.

In previous election cycles, Trump stated that he would consider a minimum wage increase, but he has not shared his opinion on the matter during the 2024 presidential campaign.

Of course, we’re a ways out from any real policy changes actually shape — but if you’re looking to make your tip management process less taxing in the interim (see what we did there?), Kickfin is here for you! Check out how you can use Kickfin to auto-calculate tip pools and send payouts directly to employees’ bank accounts in seconds.

![[WEBINAR] A Tip Pooling “Deep Dive” with Restaurant Strategy Podcast Host Chip Klose](https://kickfin.com/wp-content/uploads/2023/05/Car-Wash-Show-Postcard-April-2023-1-1.png)