In the midst of a (neverending?) labor shortage, restaurant operators are doing everything they can to encourage their best servers to stick around.

A sure-fire way to keep your current employees happy? Help them earn more money. Of course, when margins are tight, that can be tricky — which is where tips come in. Tipping allows employees to earn significantly more than what your revenue constraints might allow.

In fact, for many restaurant teams, particularly in the full-service segment, tips make up the majority of a server’s income. And if you practice any sort of tip pooling, then tips can increase take-home pay for other front-of-house and back-of-house employees, too.

While tip amounts are generally determined by the total bill and the quality of service a customer receives, there are things you can do to help your employees earn more tips. Here are a few ideas to try out at your restaurant.

1. Give them bigger sections

Your veteran servers can handle a lot more than you give them credit for. They probably want everything you throw at them, because more tables can generally mean more tip-making opportunities for them.

We get it: you don’t want customer service to slip. But you can trust your best servers to be honest about how much they can handle. If their answers vary, you can create different-sized sections where you reward top performers with more tables, while newbies get their feet wet with smaller sections.

2. Server training sessions

In the restaurant industry, you’re bound to get a lot of green serving staff. Give them the knowledge and tools they need to exceed customer expectations and operate with efficiency, so they can start earning more tips, faster.

If you don’t already have some kind of formalized training program in place, now’s the time to start. (For tips on onboarding new employees, check out our webinar here.)

Of course, there are some basics they’ll need to learn — policies, standard operating procedures procedures, how to use your tech stack, etc. If they’re new to the industry, don’t make any assumptions: introduce them to every part of the restaurant. It’s important that they understand operations from front to back and how their success is tied to the success of the whole team.

Soft skills are equally important. Being able to engage with guests in a warm, professional manner can take the dining experience to the next level — and it compensates for slip-ups here and there while employees are still learning the ropes.

3. Teach the art of the upsell

In addition to the training they receive during onboarding, it’s never a bad idea to offer ongoing sessions for newer staff and seasoned pros alike. One focus area to consider: coaching your team on the art of the upsell.

No, you don’t want your servers to turn into full-blown salespeople; but when it’s done in a way that’s focused on improving the guest experience, it has the added benefits of boosting tip amounts and increasing your restaurant sales, too.

For example, hold a drink pairing class where your team learns what drinks to suggest for each order. Help them practice presenting daily specials in a way that’s appealing and easy-to-follow. Remind them not to miss an opportunity to suggest a starter and be smart about how they position the option for a dessert. (E.g.: They’re full from dinner? Offer that pie to-go!)

Not every server will have time for extra classes (school, family, and life can get pretty hectic), so make these classes optional. Your servers who can make it will thank you for providing them with flexibility and tools to increase tips, and your customers will notice and appreciate how knowledgeable your staff is.

4. Run your kitchen efficiently

We all know that servers bear the brunt of frustrated, hangry customers. If guests are waiting and waiting for their food, they often blame the server (even if they’re not at fault) and deduct from their tips. Also, the longer a party sits waiting for their food to come out, the longer the server will have to wait to get their next table.

Want your servers to earn more money? Address any back-of-house issues that might be impacting the customer experience. Hungry guests will be much happier when their food arrives quickly, and it’ll help your servers turn and turn more tables throughout the night.

And keep in mind: For restaurants that include back-of-house employees in their tip pool, kitchen employees benefit from better tips, too — so help them understand how a rising tide lifts all boats.

5. Manage expectations at the host stand

Just like the kitchen, the host stand is completely out of the servers’ control — but it can seriously affect their tips. While you can’t really help going on a wait during a busy Saturday night dinner rush, you can train your hosts to tactfully manage guests’ expectations, so they aren’t fuming by the time their server comes to greet them.

For one, hosts need to accurately predict wait times. There’s nothing worse than telling a customer that it’ll only be a 20-minute wait and then watching them sit squirming in your waiting area for 45 minutes. Consider taking advantage of restaurant tech that can help hosts manage the floor and the waitlist.

It can also be confusing to guests if they’re on the waitlist, but they see empty tables. What they may not know is that you don’t have enough servers to cover all of the tables in the restaurant — so if that’s the case, consider asking your hosts to be proactive about explaining the situation.

Of course, when a party leaves and the table is ready to be cleaned, encourage your hosts to jump in and support busy bussers so that the next guests can be seated quickly.

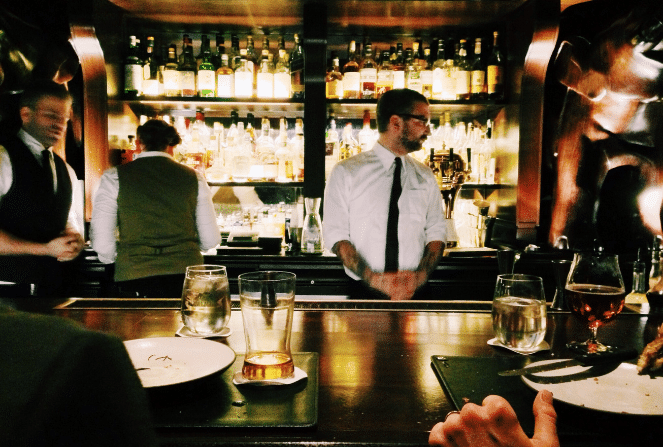

6. Put your managers back on the floor

When things go wrong, managers often swoop in to save the server’s tip. Managers are there to smooth over customer complaints and ensure a high-quality dining experience for every guest in your restaurant. But if they’re in the back office working for the entire shift, servers don’t get the support they need.

Free up your managers’ shifts so they can spend more time touching tables, refilling drinks, and supporting the FOH staff. When managers can spend more time interacting with guests and helping servers who are in the weeds, guests enjoy their dining experiences more and are happier to leave a generous tip.

(One idea to give your managers hours back in their day: Try out Kickfin’s instant cashless tipping software so your managers can spend less time counting out cash tips and crunching numbers, and more time connecting with customers and supporting your servers. Check out a demo today.)

![[WEBINAR] A Tip Pooling “Deep Dive” with Restaurant Strategy Podcast Host Chip Klose](https://kickfin.com/wp-content/uploads/2023/05/Car-Wash-Show-Postcard-April-2023-1-1.png)