About the company

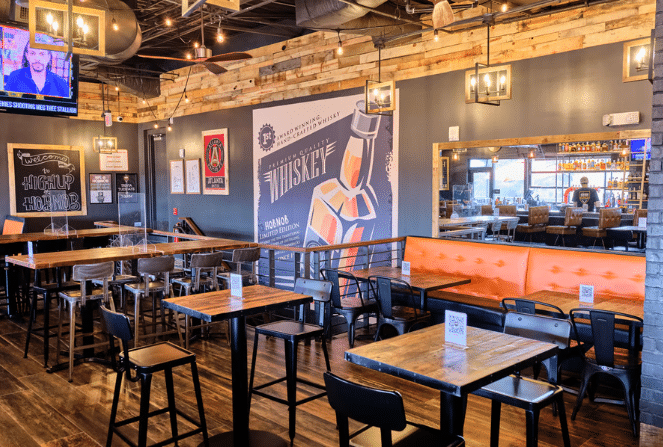

Founded by two brothers, HOBNOB is an upscale neighborhood tavern concept with a focus on elevated pub food and excellent cocktails.

Locations

6

Atmosphere

At HOBNOB, guests can enjoy everything from Sunday brunch to bourbon tastings.

Service type

Full-service

Key Results

- Cash eliminated from the tip-out process

- Cumbersome spreadsheets deleted

- 1+ hours saved after every shift, across all 6 locations

“The Kickfin-Toast integration has changed everything for us.”

Jeff Sime

HOBNOB Director of Operations

Meet Jeff.

Jeff Sime, HOBNOB’s Director of Operations, manages growth and day-to-day operations at the Atlanta-based restaurant group.

HOBNOB began as a family-owned restaurant with a focus on upscale tavern fare made with regionally sourced ingredients. It quickly expanded to six locations throughout the Atlanta metro area. Their regulars stop in to sample a wide range of bourbons, watch the big game, or catch up with friends at weekend brunch.

Cash problems come to a head

In HOBNOB’s early years, managers hand-wrote checks to pay servers and bartenders for their tips every single night. With their fast growth, this quickly became unsustainable, so they turned to cash tip-outs.

Of course, cash came with its own set of challenges — including time-consuming bank runs, risk of theft and human error, and tracking and reporting issues (just to name a few).

With more than 250 tipped employees, managers were spending at least an hour per shift, at every location on trip distribution, which required updating spreadsheets, manually calculating tips, and counting out cash. Across the entire organization, over 12 hours were lost daily to tip management.

But inefficiency wasn’t the only problem; managers were frustrated with the administrative burden that constantly pulled them off the floor — where they were needed — in order to crunch numbers and count cash. As hospitality pros, they much preferred to be interacting with guests and supporting their staff.

Kickfin to the rescue

HOBNOB’s co-owner and business director, Becky Yeremyan, began researching ways to eliminate cash when she saw how inefficient cash tip outs were becoming. Becky was drawn to Kickfin because it was designed specifically for restaurants, with restaurant operators’ needs in mind.

HOBNOB initially launched Kickfin unintegrated to automate the payout process. They immediately reaped the benefits of instant, cashless payouts, sent directly to their employees’ bank of choice.

But activating the Kickfin-Toast POS integration took their newfound efficiencies to the next level, completely automating the tip pooling process.

Kickfin x Toast: POS integration features that “just make sense”

HOBNOB built their unique tip pooling policy in the Kickfin platform, eliminating the need for spreadsheets entirely.

Implementation was fast and smooth, with easy access to Kickfin’s customer support team whenever a question arose.

“Kickfin provided gold star customer service. I don’t know if we’ve ever had this level of customer service from a software company before,” Jeff said.

Having digitized their tip distribution process, HOBNOB identified an opportunity to make tip pools more equitable. Previously, HOBNOB servers tipped out every person who worked in a support role at any point during their shift because it was too complex to account for time worked. (For example, the busser who got cut two hours before close was still collecting their share of all tips earned throughout the shift.)

Using the “time-worked” feature of the tip calculator, HOBNOB now splits tip outs based on when a check is processed — so servers are only tipping out a busser for the hours that they were cleaning tables, not for the whole shift.

The change in compensation is majorly boosting morale. “What we’re doing now is a lot more efficient, and people are happier to tip the people who are helping them — not people who were gone for most of the shift,” says Jeff.

The bottom line

For HOBNOB, distributing tips with Kickfin is paying off in spades:

- Managers run checkouts with just a few keystrokes

- Ownership feels better protected from fraud

- Servers, owners, and managers have instant access to accurate tip data

- Servers feel safer carrying less cash after shifts

- Tip distribution is more equitable for all tipped employees

“If you’re considering Kickfin, do it. It’s really been a game changer for us.”

Becky Yeremyan

Hobnob Owner & Business Director

You might also be interested in

- Restaurant Management

For restaurant owners looking to boost teamwork and make sure every employee gets their fair share, a tip pool or tip share seems like a natural solution. But like there are pros and cons to tip pooling that every operator should be aware of.

Of course, it doesn’t always make sense to pool tips. (And when it does make sense, tip pooling policies are definitely not one-size-fits-all!)

If you’re on the fence, check out our tip pooling pro-con list below and consider how they would affect your restaurant’s unique dynamics.

What are the pros of tip pooling?

It takes a lot of hard work and collaboration to deliver an excellent guest experience. For most restaurants, the primary goal of tip pooling is to ensure all employees are fairly rewarded for their contributions.

Here are a few of the benefits that tip pooling offers restaurant teams.

1. Improved performance

When executed strategically, tip pooling can bring your team together around a shared goal — delivering a top-notch guest experience — and reward them for doing so.

And when employees are all working toward a common goal, they’re much more likely to work together and go out of their way to lend a helping hand or fill in gaps. This can be particularly true for tip pools that include employees who generally aren’t directly tipped, like bussers, hosts, and back-of-house employees.

2. Reduced competition among servers

Does one section get all of the large parties (aka all the large tips)? Or does your patio section get too hot for most guests during the summer? When employees aren’t sharing tips, your workplace culture might start to feel (overly) competitive and even lead to tension or disputes. When servers start feeling slighted or get hung up on who-got-which-table, not only does that affect morale — it slows everyone down.

An equitable tip pool can keep servers from feeling like they need to keep score, so they can focus on providing top-notch service to all of the guests in the restaurant.

3. Increased focus on training

When you bring on new staff, you typically have them train with your best veteran servers. And when those vets know that their trainee will be part of their future tip pool, they’ll be more invested in the training, making sure to give them a master class in upselling and customer service.

4. More equitable distribution

Unfortunately, customer biases — conscious or not — can impact tip amounts. Whether based on race, gender, or other factors, this kind of discrimination can affect your employees’ livelihoods.

While restaurant operators can’t control if some employees receive preferential treatment, they can help to compensate for those injustices by pooling and fairly distributing tips.

Cons of Tip Pooling

While most restaurants these days run some form of tip pool or tip share, there are some common drawback and pitfalls to tip pooling, which are worth considering before you implement a new policy

1. Top performers may feel negatively impacted

If your best servers are consistently bringing in far more than the standard 18-20% in tips, they might not be so pleased to share with employees who may not have the same experience, talent or work ethic.

Couple that with the fact that some servers can turn tables much quicker than others, resulting in a higher volume of sales and a whole lot more tip income — well, your top earners could start feeling cheated by the tip pool.

And in a tough labor market, if a hardworking employee isn’t happy with their earnings, they likely have other options.

2. Under-performers can slip through the cracks

On the flip side of that: a tip pool could allow lower-performing employees to slip through the cracks. If you’re not closely evaluating the average tip amount (and average check size!), you may miss that one of your employees is struggling with their customer service.

3. Compliance is an added consideration

Tip pooling is regulated at the federal and (usually) state level. Some municipalities also have their own rules around how to legally pool tips. These laws can get pretty complicated, making it all too easy to fall out of compliance without even knowing it. For example: managers can’t participate in a tip pool; but what happens if a manager is also performing server duties? Can you include back-of-house in your tip pool? Does your eligibility for the tip credit change if you operate a tip pool? It’s important to know the answers to all of these questions and fully understand the laws that apply to each of your locations. (Especially if you have locations in multiple states!)

Tip Pooling Pros and Cons at a Glance

That’s a lot of information to take in, so here it is a handy-dandy pro-con chart.

To Pool or Not to Pool?

The majority of restaurants in the U.S. operate some form of tip pool. At Kickfin, we’ve worked with thousands of restaurant teams who participate in tip pooling or tip sharing. We’ve found that often, the positives outweigh the negatives.

But that comes with a major caveat: the best tip pooling teams have been strategic and intentional with their policies — and as a result, no two tip pooling policies look exactly the same.

If you want to set yourself up for tip pooling success, here are a few general rules of thumb.

- Evaluate your requirements: Ask yourself why you’re running a tip pool. What needs are you trying to address or problems are you trying to fix? Specifically consider your restaurant type, team size, org chart, and local market to find the best policy for you.

- Don’t overcomplicate: It shouldn’t require a degree in calculus to calculate your tip pool. If you feel like it’s getting unwieldy, it’s possible you’re setting your team up for mistakes and tracking issues.

- Get feedback for better buy-in: This shouldn’t be a decision-by-committee scenario, but it’s worth checking with management and even some of your team’s unofficial leaders to get their input before running with a new policy. This can help get the rest of your employees on board.

- Write it down and run it by your counsel: Your tip pooling policy should be on paper, in black and white. You should also have your legal counsel review it to make sure you’re not inadvertently out of compliance with tip pooling regulations.

- Communicate everything: Once you’re feeling good about your policy, share it. Make sure every tip-eligible employee understands how it works and has the opportunity to ask questions.

- Ensure transparency by tracking everything: It’s not enough to share your policy. It’s important that every payout is tracked, including how those payouts were calculated. Not only does that streamline accounting and reporting; it also creates a culture of trust with your employees. If there is ever any question around a payout, having a digital paper trail is invaluable.

The best tip pools are automated

Tip pool calculations often happen in a spreadsheet, which is less than ideal. Kickfin integrates with your POS, so you can eliminate spreadsheet math, reducing the risk of human error and ensuring every payout is accurately calculated and tracked. Plus: Kickfin customers can send instant, cashless payouts directly to their employees’ bank of choice.

The result: All the benefits of tip pooling, without the hassles, risk, and time required. (In fact, many of our users can calculate and pay out tips at the end of each shift in under 60 seconds!)

Want to learn more? Request a demo today.

- Product and Company News

Kickfin has earned a top spot on the 2025 Inc. Regionals list in the Southwest region! This recognition places us among the fastest-growing privately held companies in America—and we couldn’t be prouder of what this means for our team, our customers, and the restaurant industry at large.

A Milestone Achievement

As the #1 tip distribution platform, Kickfin is trusted by thousands of restaurant teams to automate tip pooling and payouts. Since 2017, our technology has given managers hours back in their week while improving accuracy, visibility, and reporting for operators.

Only 951 companies made the cut across all regions, and in the Southwest alone, the businesses on this list contributed 13,809 jobs to the U.S. economy while achieving a median growth rate of approximately 106 percent from 2021 to 2023.

Powering the Future of Tip Management

In the past year, Kickfin has taken automated tip management to a whole new level. In addition to exciting new features that make our platform more robust than ever, we continue to add to the list of our direct integrations with the leading POS brands—which currently includes Toast, SkyTab, Square, Heartland, RPOWER, PAR POS, Oracle MICROS, NCR Aloha, and more.

→ See how the Kickfin-Toast integration “changed everything” for HOBNOB restaurants

Kickfin’s POS integrations give our customers the ability to auto-calculate even the most complex tip pools in just a few clicks, which eliminates unwieldy tip spreadsheets, saves managers even more time, and gives operators unprecedented visibility into payout calculations and history.

A Heartfelt Thank You

This achievement wouldn’t have been possible without the trust of our customers and the dedication of our team.

As Justin Roberts, co-CEO of Kickfin, puts it: “We’re incredibly grateful to our customers who have made this growth possible by trusting Kickfin with their tip management needs. This recognition is a testament to the value that automated tip management brings to restaurant teams—helping them save time, reduce risk, and take care of their people.”

We’re honored to be included in the 2025 Inc. Regionals list, and we’re excited to see what the rest of 2025 has in store!

- Product and Company News, Technology and Software

You heard that right — Kickfin has added yet another partner to our ever-growing list of POS integrations!

RPOWER POS has joined the list of leading POS systems that now integrate with Kickfin so users can fully automate tip calculations and payouts.

RPOWER is a trusted name in the restaurant industry known for its handheld devices, online ordering capabilities, and robust reporting. RPOWER’s dedication to staying on the cutting edge of restaurant tech makes the integration with Kickfin a perfect match!

With the RPOWER-Kickfin integration, restaurant operators can:

- Easily build out highly complex tip policies

- Calculate tip outs based on roles, shifts and hours worked

- Distribute tips directly to employee bank accounts

- Establish an electronic “paper trail” for every tip out

( …and more. Dive into the latest Kickfin updates for the full scoop.)

Like all of our integration customers, when RPOWER users activate the Kickfin integration, they’ll have access to our robust Customer Success team (at no extra cost!). We’re here 24/7 to review and build out your tip policy within the platform, so you’ll be up and running in a flash.

Collaboration with Riot Hospitality Group

This integration was especially exciting because we worked hand-in-hand with one of our longstanding customers, Riot Hospitality Group, to ensure the integration checked every box — and that it could handle their complex tip pooling policies.

“Kickfin has been an outstanding partner to Riot Hospitality Group for years,” said J Goldin, the systems director for RHG.

“They had already helped us go fully cashless, which eliminated a lot of risk for our teams. When we decided to completely automate tip payouts, they were a natural choice to help with that as well. We worked hand in hand with Kickfin and RPOWER to ensure the system could handle the intense complexity of our rules, while still being incredibly easy to use for our operators.”

As our co-CEO Justin Roberts puts it, this integration is a “no brainer for RPOWER users who understand how valuable their managers’ time is.”

RPOWER users, we’re ready for you! Schedule a demo to learn how you can activate your integration.

(Not an RPOWER user but want to take advantage of these time-saving features? See if Kickfin is integrated with your POS!)

- Product and Company News

We kicked off 2025 with some major (!) updates to our Tip Calculator features.

It was a big release, and we’ll break it all down for you here — but the big headlines are:

- More integrations

- More speed

- More flexibility

If you’re not already using Kickfin — or if you haven’t integrated Kickfin with your POS to automate tip calcs just yet — this is for you! Read on to see how you can use Kickfin’s newest tip calc features to un-clunk your tip pooling process.

More integrations, coming right up

We’re continuing to roll out integrations with the leading POS systems, giving restaurant teams the power to auto-calculate tip pools and shares in a matter of clicks.

(Side note: Kickfin only builds direct POS integrations — not using a third-party solution! — which streamlines your tech stack and keeps your costs lower.)

We were thrilled to add RPOWER to our growing list of integrations, which already includes Toast, Square, SkyTab, SpotOn, PAR and more.

If you’re an RPOWER user and you’re not yet a Kickfin customer, request a demo and we’ll show you the integration in action!

Handle autograts with ease

For servers and bartenders handling large parties, autograts can be great — but for managers, they can turn into a logistical nightmare. Now, Kickfin can help with that…

With this latest release, you can break tips and autograts into separate categories with their own set of rules for distribution. You have the flexibility to manage autograt tip splits completely separate from regular tip outs, so you can fairly reward a hardworking server-bartender-busser trio for a job well done on a 30-top.

Tips & Autograts Broken Out on Tip Data Page

Tips & Autograts Broken Out on Review Screen

With this new set up, you’ll also get more transparency in reporting. You’ll be able to see the breakdown of tips and autograts collected by each user in your reporting dashboards (more on that later!).

Include cash tips in your distributions

You heard that right — we can now distribute shares of cash tips digitally, directly to your employees’ bank accounts. Instead of doing the math on cash tips by hand, you can easily add cash to your tip pool, and we’ll calculate the share among employees for you.

Important note: cash distributions aren’t available for all of our integration partners. Contact us for more info.

Advanced Tip Rules (for even the unruliest policies)

Think your tip policy is extra tricky? Don’t worry — we’ve seen ‘em all. And there aren’t many Kickfin can’t handle, thanks to our Advanced Tip Rules feature.

If you have Advanced Tip Rules enabled, we’ve added a few new capabilities so you can further customize your tip share while we take care of the complicated math behind the scenes. Here are just a few examples of the new features we’re rolling out.

Not using Advanced Tip Rules? Reach out to us if you’d like to enable these features.

Per Segment Tip Sharing

We’ve been calculating tip shares on a check-by-check basis. For example, if you have servers sharing a percentage of tips with bussers, we would only calculate and deduct that percentage if a busser was working at the time that a check was processed. We call this Per Check Tip Sharing.

Now, we’re introducing Per Segment Tip Sharing, which gives you the option to deduct a tip share from every check processed during a shift. Let’s go back to our example — servers sharing a percent of tips with bussers. With Per Segment Tip Sharing, we would deduct a percentage of the server’s tip for every check processed, even if the busser gets cut two hours before the server.

Split Evenly

Would you prefer that all of your support staff take home an even share of their tip pool? We can now make that happen.

Previously, our tip shares entered a pool and were divided among beneficiaries based on how many minutes they worked during a shift, which we call splitting by Time Worked. With our new product update, we’re introducing the Split Evenly option, which enables you to send an equal part of a tip share to every beneficiary that worked within a segment.

More accuracy

In the past, cash autograt payments were lumped in with credit card autograts and credit card tips, resulting in credit card fee deductions on cash transactions. But that is no more!

Now we’re able to deduct credit card fees only where they apply, so you’ll no longer see credit card fee deductions attached to cash autograt transactions.

Plus, we’ve gotten even better at math. With our new update, we can prevent rounding errors, so our tip disbursal should match the tips collected in your POS to the penny.

Revamped and expanded reporting

We added new reporting views to give you more insight into each pay period, individual pay sets, and tip calculations. Here’s a quick look at your new pay period report with expanded filters:

Main Pay Period Report - Filter Bar Expanded

You’ll notice that there are now separate columns for tips and autograts, but you can still view the gross amount earned (tips + autograts = gross).

And it doesn’t stop at the main reporting page. You’ll see this more detailed reporting when you look at individual employee pay period reports, review a specific pay set, or export the information from any of your reporting dashboards.

We know this is a lot of new information to take in — but we’ve got you covered with our full Product Release Recap. Simply log in to Kickfin, click on your name in the upper left corner and select “Support” to access that portal.

Not using Kickfin? Dying to get rid of your old-fashioned gratuity management system? Drooling over these new features? We’d love to have you. Reach out to us today to see how our platform could save you time and money.

See Kickfin in action!

- No contracts or setup fees

- Implement overnight

- 24/7 customer support