Kickfin has officially been added to the Toast Marketplace — making it easier than ever for thousands of Toast users to auto-calculate tips and pay them out in real time.

Toast is a favorite POS system for restaurants, food trucks, and bars. And now, Toast has partnered with Kickfin to launch an integration that makes tip pooling and payouts faster, smarter and safer for restaurant teams.

Why should I integrate?

When you automate calculations by integrating Kickfin with Toast, you can save even more time, get full visibility into payment calculations and history, and ensure the accuracy of every payout.

Specifically, the Kickfin-Toast integration gives you the power to:

- Calculate tips in seconds with real-time tip and labor data from Toast.

- Implement highly customized tip sharing policies with a few clicks of a button.

- Incorporate shifts, hours worked, points, sales categories, and more in your tip rules.

- Maintain an electronic record of each tip and the calculations used.

- Easily track tips by pay period for reporting and taxation.

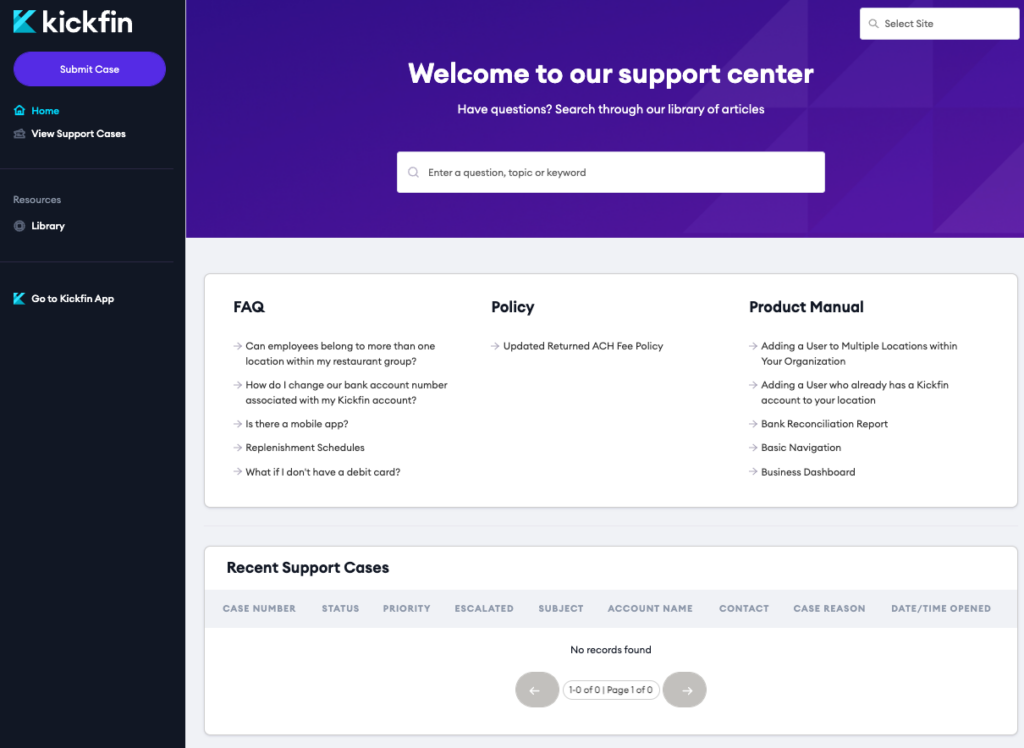

How do I add the Kickfin integration?

For current Kickfin users, follow these 3 steps to implement the Toast integration:

- Activate your site: If you’re interested in launching the Kickfin-Toast integration, visit the Toast Marketplace and activate your site(s).

- Complete an Automation Analysis: Once activated, the Kickfin team will contact you to gather your written tip policy and example spreadsheet from recent payouts. We’ll use these documents to help you set your custom tip calculation rules within Kickfin.

- Go live! You’re ready to auto-calculate tip amounts and (finally!) say so-long to spreadsheets. 🎉

Not a Kickfin user yet? No problem! You can still activate your site on the Toast Marketplace. Then, reach out to our team at sales@kickfin.com or book a meeting from our demo form, and we’ll help you get set up!

Customer Spotlight: Bar Louie Launches Kickfin-Toast Integration

Bar Louie takes great pride in making tip distribution equitable for all of their employees, so they rely on a complex tip pooling system to ensure fair pay.

Prior to using Kickfin, managers spent 45 minutes at the end of every shift to calculate tip amounts and divvy up funds to all of their servers. Now, they’ve streamlined their tip-out process with the Kickfin-Toast integration — and managers are doing the same work in less than a minute. Across all 60 locations, that’s a potential annual savings of 15,000 hours.

>> Hear more Kickfin success stories

More integrations, coming right up

We’re excited about our new partnership with Toast and the opportunity to make digital tipping a reality for their customers. For restaurants who aren’t using Toast, don’t worry! We’re rolling out integrations with other leading POS systems, including Shift4/SkyTab, Heartland, Oracle, and more.

For more information about Kickfin’s POS integrations, head over to our Integrations page, or check out a demo of our platform.

![[Product Announcement] It’s here: Introducing Kickfin 2.0!](https://kickfin.com/wp-content/uploads/2021/05/12.9-inch-iPad-Pro.png)